What in the World is Going On? / Report from Panama - November 2014

Presented with permission of Bob Adams, of Retirement Wave.

"Strategic planning is worthless - unless there is first a strategic vision."

John Naisbitt (1929 -?) - American author of multiple books on the future and a leading analyst of global trends. Still going strong at 85.

John Naisbitt (1929 -?) - American author of multiple books on the future and a leading analyst of global trends. Still going strong at 85.

Depending on when you think the “global financial crisis" began, at least five to seven years have passed possibly more. This is an on-going crisis that does not end, only changes in one direction or the other from time to time. Or perhaps it improves in some nations, only to get worse in others. The problem with this situation is that nations are so inter-connected in the global economy today that no nation, no matter how much improved, can isolate itself from others that continue to decline.

Folks, in all the many years I have been responsible for analysis of socio-political and economic development of nations or regions, I have never seen such a mess. I will not waste a lot of your or my time on this, but it cannot be ignored because it is global.

Any crisis of this significance requires a “plan" of some sort to help us work our way out of it. It will not be easy, but it is essential. Otherwise, we leave ourselves vulnerable to events. Instead of controlling them, they control us.

There is no plan, beyond those developed by individual nations and, unfortunately, many of those are inadequate or simply failures. As Mr. Naisbitt says in the quotation above, we cannot plan successfully until we have a strategic vision of where we expect the plan to take us. A “strategic" vision does not have to provide details. It is only expected to provide a goal that we can commit to reaching. Once we have that vision, then we can focus on how it is to work, what is required for it to work, and set goals and timeframes. This is impossible today even when nations, such as those of the eurozone, clearly recognize that they have a common need to create that vision and formulate the plan as quickly as possible. And it is not only the eurozone. This problem can be found in the all the so-called “advanced" economies and too often in the largest “emerging" economies as well.

I have great confidence that these distressed nations will eventually come up with their vision and a plan to back it up. They include some of the most competent professionals in all of history. Intellectual power is certainly not the problem. Getting something done is the problem. In common English, we might say that it is not enough to be “book-smart"; you have to be “street-smart" too.

The point in mentioning here is simple. If you are as frustrated or upset as I am at the failure of the leadership elite to get their act together and get something done, then we have a responsibility to ourselves and those we love. We have to create our own “strategic visions" and plans to back them up.

Whatever you choose for your vision is your business entirely. All I can say to you is that I am much more comfortable witnessing it from here in Panama than living in the middle of it. Whether you choose to relocate to Panama is not important to me, as I have said many times before. The only thing that is important is that you are where you need to be. If that is Panama, fine! If not, fine! But I do encourage you to give relocation very, very serious consideration if the global financial crisis and everything associated with it “back home" is seriously interfering with your life and your peace of mind. It is not pretty from here, but at least it is a few thousand miles/kilometers away!

Folks, in all the many years I have been responsible for analysis of socio-political and economic development of nations or regions, I have never seen such a mess. I will not waste a lot of your or my time on this, but it cannot be ignored because it is global.

Any crisis of this significance requires a “plan" of some sort to help us work our way out of it. It will not be easy, but it is essential. Otherwise, we leave ourselves vulnerable to events. Instead of controlling them, they control us.

There is no plan, beyond those developed by individual nations and, unfortunately, many of those are inadequate or simply failures. As Mr. Naisbitt says in the quotation above, we cannot plan successfully until we have a strategic vision of where we expect the plan to take us. A “strategic" vision does not have to provide details. It is only expected to provide a goal that we can commit to reaching. Once we have that vision, then we can focus on how it is to work, what is required for it to work, and set goals and timeframes. This is impossible today even when nations, such as those of the eurozone, clearly recognize that they have a common need to create that vision and formulate the plan as quickly as possible. And it is not only the eurozone. This problem can be found in the all the so-called “advanced" economies and too often in the largest “emerging" economies as well.

I have great confidence that these distressed nations will eventually come up with their vision and a plan to back it up. They include some of the most competent professionals in all of history. Intellectual power is certainly not the problem. Getting something done is the problem. In common English, we might say that it is not enough to be “book-smart"; you have to be “street-smart" too.

The point in mentioning here is simple. If you are as frustrated or upset as I am at the failure of the leadership elite to get their act together and get something done, then we have a responsibility to ourselves and those we love. We have to create our own “strategic visions" and plans to back them up.

Whatever you choose for your vision is your business entirely. All I can say to you is that I am much more comfortable witnessing it from here in Panama than living in the middle of it. Whether you choose to relocate to Panama is not important to me, as I have said many times before. The only thing that is important is that you are where you need to be. If that is Panama, fine! If not, fine! But I do encourage you to give relocation very, very serious consideration if the global financial crisis and everything associated with it “back home" is seriously interfering with your life and your peace of mind. It is not pretty from here, but at least it is a few thousand miles/kilometers away!

The Panama Scene

When an economy is growing healthily, people are happy and happy people are a lot more fun to live with then the unhappy people in economies that are stagnant or declining. Panama has been one of the fastest growing economies in the world for a decade and the fastest growing in the Western Hemisphere from Canada in the far north to Argentina in the far south almost every year in that decade. So far this year, it continues to be #1 in the hemisphere.

The standard way to measure an economy is GDP (Gross Domestic Product). That is an estimate of the total wealth created in a nation in a year. Because the cost of living is much lower in some economies and higher in others, the difference Is corrected by something called PPP (Purchasing Power Parity). Boring, but it is a critical measure.

Panama’s economy grew at a 6% rate in the first three months of the year and at a 6.3% rate in the second three months. Overall for the first six months, it grew 6.2%. I have actually heard some people suggest that this is bad news since our rate of growth has been faster in recent years.

I very much disagree. A slowdown in GDP growth has occurred in most nations this year. That is why we are still #1 in Latin America, despite a lower rate than last year’s 8.4%. Furthermore, this slowdown was expected in Panama. The standard estimate for our 2014 growth at the end of the year is basically 6.5 % to 7%. It is still expected to be the case. The 6% in the first quarter reflected a situation I discussed in the last Report. A Spanish firm, along with its Italian partner, was in financial trouble and attempted to force the Panama Canal Authority to give it more money. To do that, they brought most construction for the Canal’s expansion to a dead halt for weeks. That was what led to the slower rate for that quarter.

Remember, everything is relative. If your income goes up 6%, but everyone else goes up 12%, you feel bad. If your income goes up 6%, but everyone else goes up 2%, you feel great and you have good reason to do so. The latter has been true for us. No one needs to shed a single tear for Panama!

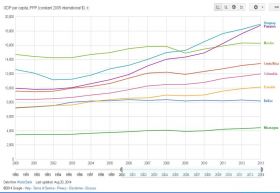

One way to demonstrate what higher growth rates mean so that is easily understood is create a chart comparing Panama and some other Latin American nations over time. Instead of using percentages, we can use the GDP numbered divided by the total population so we can compare the results per person (per capita). That makes it possible to compare nations very different in population.

I did that and the result is the chart below. I wish it was a little easier to read, but I trust you can handle it. The important question is, which nation do you think has people who are happy with their economy? Are you surprised that Panama has passed Mexico as well as smaller nations? This is the joy of being a nation with a small population. Fewer people means every person gets a bigger “slice of the pie". At the rate things are going now, the difference will be even more favorable to Panama by the end of this year. And we are very likely going to pass Uruguay, a nation commonly thought to be more economically successful than Panama.

Mexico has gotten a lot of media coverage over this period of nearly a quarter of a century, but it has 120 million people, 30 times the population of Panama. That means that the average Panamanian’s “piece of the pie" is bigger than each average Mexican's piece. And when all is said and done, you do not really care how big the pie is. You care about how big your piece is.

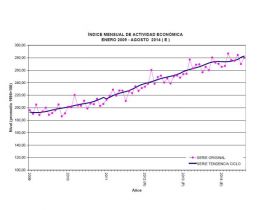

Readers of past Reports from Panama know that I also use another statistic to measure economic progress. It is called the Index of Monthly Economic Activity (IMAE in the Spanish version). This figure is faster to put together, so it is more up-to-date than GDP. Although it is not a complete picture of the economy, it includes all the major sectors and it follows the same path as GDP, so we can now take a look at that. This takes us through August of 2014 from January of 2009. The pink line shows the bouncing back and forth that is common for this statistic. The blue line shows the trend and tells the full story.

You can see the “slowdown" in the early part of 2014 due to the slowdown at the Canal , but you can also see that we are back on the road again. No, we do not need your tears!

"Bits and Pieces"

I always include a variety of smaller items. Many readers seem to enjoy them and they do supply a little more detail on affairs in Panama. As usual, I had far more than I could possibly use here, so the selection covers a wide variety of subjects briefly.

- Many people have an image of "machismo" in Latin America. Well, this sort of male attitude is still found here, as it is everywhere, but nowhere near as bad as the old-time images. Women are definitely coming into their own in Panama. 70% of graduates of the University of Panama this year were women, and 74% of graduates receiving advance degrees were women. When I first arrived here a little over ten years ago, women were absent from construction sites. In recent years, it has become common to see women around construction, but as engineers or architects, not laborers. Looks like they are starting near the top in construction! And with all those degrees, we will be seeing more of them in coming years.

- Business at the Panama stock and bond exchange grew 37% for the period January through September to $4.2 billion (4,200 million) from $3.1 billion (3,100 million) for the same period in 2013. The majority represents corporate and government bonds as the market for stocks grows, but is still comparatively small. The point is that the market is doing well and money is certainly changing hands!

- New flights to Panama keep being introduced. With French arrivals up nearly 80% since last year, Air France is adding a fifth weekly direct flight to Panama. They have been filling 88% of their seats and they expect more to come. This now means we have 19 weekly flights from Paris, Amsterdam, and Madrid, along with four flights from Lisbon that stop at both Bogota in Colombia and Panama City.

- Air Canada will begin offering three direct flights from Toronto each week beginning in December. These are in addition to current direct flights from Toronto and Montreal flown by Panama’s airline, COPA Air.

- Panama ranked 48th of 144 economies on the World Economic Forum's Global Competitiveness Report for 2014-15. The only Latin American nations ahead of us are Puerto Rico (a US territory) and Chile.

- In a statement from the Panama Canal Authority (ACP), the Panama Canal closed fiscal year 2014 with an increase of 2.0% in tonnage and 3.2% in toll revenues, which totaled $ 1,910.6 million during the term 1 October 2013 to 30 September. Despite all the construction involved with the expansion, the Canal keeps doing its job and doing it well.

- The Ministry of the Economy in El Salvador regularly reports gasoline prices in Central America. As Panama is not considered a Central American country, it is not included, until the latest report. So here are the reported prices as of 13 October (by US gallon) and prices are in US dollars. Prices have fallen on world markets recently, so these may have fallen too, but the comparison remains the same and has been this way for a long time:

Diesel

Panama 3.43

Guatemala 3.62

El Salvador 3.76

Nicaragua 4.08

Honduras 4.10

Costa Rica 4.57

Regular

Panama 3.75

El Salvador 3.96

Guatemala 3.97

Honduras 4.51

Nicaragua 4.55

Costa Rica 5.16

Special (high octane)

Panama 4.05

Guatemala 4.16

El Salvador 4.35

Nicaragua 4.79

Honduras 4.81

Costa Rica 5.39

Panama 3.43

Guatemala 3.62

El Salvador 3.76

Nicaragua 4.08

Honduras 4.10

Costa Rica 4.57

Regular

Panama 3.75

El Salvador 3.96

Guatemala 3.97

Honduras 4.51

Nicaragua 4.55

Costa Rica 5.16

Special (high octane)

Panama 4.05

Guatemala 4.16

El Salvador 4.35

Nicaragua 4.79

Honduras 4.81

Costa Rica 5.39

- FDI stands for Foreign Direct Investment and refers to large-scale investments. Every nation on the planet wants as much FDI as possible. In the first six months alone of this year, Panama received $2.6 billion ($2,600 million) in FDI. That is up 26% from the first half of last year. That growth rate ranked us #1 of the thirteen Latin American economies receiving the most FDI. For comparison, Colombia only great 10%, Uruguay rose 9% and Costa Rica went negative, falling 21%.

- To honor an election promise, the new administration introduced “price controls" for some food items commonly eaten by low-income families. I do not have any interest in price controls. Wherever I have seen them, they have distorted the market, hurt producers and merchants, and can be very difficult to reverse later on. However, in this case, the “controls" are minimal. For example, a few days ago I was at the supermarket looking at perhaps 40 types of cheese for sale in the deli department. Two had controlled prices, both cheeses commonly eaten by low-income families, the intended beneficiaries of the controls. Otherwise, everything else was the same. This very limited approach also helps limit the damage, but it is still not a good thing for the producers of the cheese and the owners of small neighborhood markets. However, the impact is almost invisible to most of us, so it is a non-event in our lives. Producers and shop owners have complained, understandably. The issue is out there and there is reason to expect that the controls may be phased out, but that is for the administration to decide.

- Grupo Viva, the owners of VivaColombia, a low-cost airline in Colombia, and VivaAerobus, a low-cost airline in Mexico, are setting up their headquarters in Panama as they expand their operations to cover more of Central and South America. VivaColombia already provides low-cost flights to two cities in Colombia from Panama and this new operation should substantially increase low-cost flights in the region. That will be very welcome as traditional airline flights here have been higher-priced due to a lack of low-cost competition. Best of all, having their operation centered here will assure additional flights to and from Panama.

- Savings are becoming an important part of Panamanian life. Deposits in the banking system increased by 47% in August compared to a year ago for a total of more than $73 billion ($73,000 million). Although global businesses and the Canal bring in a lot of money from outside, nearly $45 billion ($45,000 million), up 54%, were domestic deposits of which more than $34 billion (up 49%) were deposited by individuals, an increase of 49% compared to August of 2013. Not bad for a small nation of less than four million people.

Now on to other matters…

What could go wrong in Panama?

From 2004 through 2007, RW Members, both those writing me and those visiting here for the first time, were excited and positive about Panama, especially its real estate market. They had great confidence that Panama would continue to prosper and that they would be able to resell a property for a lot more than they had paid for it.

In early 2008, there was a shift. Members were less certain about Panama, but still generally positive.

Later in 2008 and definitely in 2009, many Members were convinced that Panama’s “economic miracle" was going to collapse, right along with the US economy. A little later, Europe began to feel the pain and the stress among European RW Members increased substantially. RW members from Asia and Latin America are far less likely to be concerned and remain so today.

From 2010 on, it has become common for Members to ask, “What could go wrong in Panama?" If I mention something positive, many will immediately question it, even argue, despite knowing very little about the nation’s economy.

What I am saying is that, most of the time, what these members have to say about Panama tells me nothing about Panama, but it tells me a lot about their home nations.

This is perfectly normal human behavior. We all do it. Not knowing much about a new nation, we do what comes easiest. We compare it to our own. Having spent nearly five decades working and/or living in nations on several continents, I can assure you that this does not work well. There are real differences among nations, especially between those with growing economies and those with declining economies. People from the first set of nations tend to look at everything positively. Those from the second set tend to look at everything negatively.

But the question is perfectly legitimate. In answering that question from my perspective, I simply say, “The greatest threat to Panama’s continued economic growth comes from North America, Europe, and a few other nations (Japan, China, Russia are examples)."

It is very possible that these nations or at least most of them do not get their act together soon enough to avoid another global financial crisis. What about Panama? Am I worried that I am living here? No, quite the opposite. I have two reasons.

Track record - We have already passed through a global financial crisis, the worst since the Great Depression of the 1930s. Panama did very well, despite its close connections with the global market due to the Panama Canal. People were surprised to find that Panama had such a widely diversified client base, plus a much diversified economy than most expats think, that it sailed through that crisis with the best performance of any nation in the Western Hemisphere from Canada to Chile. There are very few, if any, of you whose nations did half as well. In fact, Panama’s “crisis" growth rate of 4% in 2009 is still higher than most of RW member nations today, five years later. Those are facts, not opinions.

Relativity - Everything is relative. Suppose your neighbor gets a 20% raise in her salary one year and the next year only gets a 10% raise. She is disappointed. Meanwhile, you lose your job. Do you think she wants to trade places with you? Or would you like to trade places with her? Do you feel sorry for her because she got only a 10% raise? Or is she more likely to feel sorry for you who got a 100% cut in salary? In the event of another global financial crisis, I very, very much prefer being here in Panama than in any of the other nations mentioned above. If it is bad here, I tremble to think how bad it will be “up there" or “over there".

Panama has its problems and its challenges, no doubt about it. Our educational system, both public and private, is in need of major improvement. Much has been accomplished in the last decade, but much, much more is necessary. Our young people are not being prepared for the growing demands of a rapidly growing nation. There has an astonishing improvement in transportation and communication infrastructure in Panama, but we still have to run to catch up with our growth. No sooner is one project done, than another must start. There are all sorts of strains and worries in a nation that is growing so quickly, but no one wants to trade them for those faced by other nations whose economies are stagnant or declining.

As I have said more than once here at RW, if you expect to find “paradise" in Panama, you will be disappointed. You will have to die before you have a chance to find that. Panama is a human society and like every other human society, it has its problems. But as we often say in English, there are problems…and then there are problems. In other words, we will take our problems. Other nations can keep theirs!

In early 2008, there was a shift. Members were less certain about Panama, but still generally positive.

Later in 2008 and definitely in 2009, many Members were convinced that Panama’s “economic miracle" was going to collapse, right along with the US economy. A little later, Europe began to feel the pain and the stress among European RW Members increased substantially. RW members from Asia and Latin America are far less likely to be concerned and remain so today.

From 2010 on, it has become common for Members to ask, “What could go wrong in Panama?" If I mention something positive, many will immediately question it, even argue, despite knowing very little about the nation’s economy.

What I am saying is that, most of the time, what these members have to say about Panama tells me nothing about Panama, but it tells me a lot about their home nations.

This is perfectly normal human behavior. We all do it. Not knowing much about a new nation, we do what comes easiest. We compare it to our own. Having spent nearly five decades working and/or living in nations on several continents, I can assure you that this does not work well. There are real differences among nations, especially between those with growing economies and those with declining economies. People from the first set of nations tend to look at everything positively. Those from the second set tend to look at everything negatively.

But the question is perfectly legitimate. In answering that question from my perspective, I simply say, “The greatest threat to Panama’s continued economic growth comes from North America, Europe, and a few other nations (Japan, China, Russia are examples)."

It is very possible that these nations or at least most of them do not get their act together soon enough to avoid another global financial crisis. What about Panama? Am I worried that I am living here? No, quite the opposite. I have two reasons.

Track record - We have already passed through a global financial crisis, the worst since the Great Depression of the 1930s. Panama did very well, despite its close connections with the global market due to the Panama Canal. People were surprised to find that Panama had such a widely diversified client base, plus a much diversified economy than most expats think, that it sailed through that crisis with the best performance of any nation in the Western Hemisphere from Canada to Chile. There are very few, if any, of you whose nations did half as well. In fact, Panama’s “crisis" growth rate of 4% in 2009 is still higher than most of RW member nations today, five years later. Those are facts, not opinions.

Relativity - Everything is relative. Suppose your neighbor gets a 20% raise in her salary one year and the next year only gets a 10% raise. She is disappointed. Meanwhile, you lose your job. Do you think she wants to trade places with you? Or would you like to trade places with her? Do you feel sorry for her because she got only a 10% raise? Or is she more likely to feel sorry for you who got a 100% cut in salary? In the event of another global financial crisis, I very, very much prefer being here in Panama than in any of the other nations mentioned above. If it is bad here, I tremble to think how bad it will be “up there" or “over there".

Panama has its problems and its challenges, no doubt about it. Our educational system, both public and private, is in need of major improvement. Much has been accomplished in the last decade, but much, much more is necessary. Our young people are not being prepared for the growing demands of a rapidly growing nation. There has an astonishing improvement in transportation and communication infrastructure in Panama, but we still have to run to catch up with our growth. No sooner is one project done, than another must start. There are all sorts of strains and worries in a nation that is growing so quickly, but no one wants to trade them for those faced by other nations whose economies are stagnant or declining.

As I have said more than once here at RW, if you expect to find “paradise" in Panama, you will be disappointed. You will have to die before you have a chance to find that. Panama is a human society and like every other human society, it has its problems. But as we often say in English, there are problems…and then there are problems. In other words, we will take our problems. Other nations can keep theirs!

The Real Estate Market

I took a moment to look at what I had written in the last Report from Panama and I realized it was all the same today. So I am going to repeat it here. For those who have read it in the past, I suggest you just scan through it to be reminded of some basic principles. If this is your first time, I encourage you to read the whole thing. It is not complicated and it will not take you much time.

If there is one word I would use to describe the residential real estate sector in general in Panama, it is "stable". Prices are not rising dramatically nor are they falling dramatically. There remains a very wide range of prices for a very wide range of houses and condos. There is a home for you at whatever price level you can afford, but it is not that simple.

The challenge is to find the home you can afford in the area where you want to live. That is not only your challenge. Everyone faces it, even the folks with plenty of money. It is the "area where you want to live" that is as important as the money you have to spend. Only you can determine that.

People often ask me, "Where is the best place to live in Panama?" or "Where is the cheapest housing?" or "What is a reasonable price for a house?" These are questions I cannot really answer, just like a lot of other people in Panama. We do not know what is truly important to you and you do not yet have a clear idea of what it is you want since 95% or more of you have never visited, so the only reasonable solution is simple. You have to come and look for yourself.

But do keep a few things in mind.

- Do not sign any contract for a property without first having your lawyer (not the seller’s lawyer) review the contract’s provisions and tell you exactly what they require in a language you understand. Nothing is more frustrating to me than to hear that someone is planning to legally obligate themselves to a purchase without having first consulted a lawyer. They tell me they do not want to "waste" the money. Then later, they discover there is a section or clause of the contract that hurts them, but they knew nothing about it. When that happens, that is when they really waste money.

- Do not buy a vacation home, buy a home to live in. You are not buying a view of the mountains, a view of the ocean, or a tropical paradise, you are buying the home you will live in every day. First, find the home that works for you in an area that provides whatever amenities you need to be comfortable. Consider the view or setting to be an extra bonus, but do not let them be the deciding factors. Remember, no matter where you live in Panama, it is almost impossible to be so far from the ocean or the mountains that you cannot visit easily when you want to.

- There is no such thing as a "gringo price", but there is an "ignorance price". No seller cares what passport you carry, what your native language is, or what your native culture is. They simply want to sell at the highest possible price.

Look, I was born and raised in a small village (less than 1,000 residents) in rural New York State in the US. We were surrounded by beautiful countryside. If someone who looked rich rolled in from New York City, fell in love with land we owned, appeared to be an otherwise ignorant "foreigner", and asked us how much we wanted for our land, we would very likely have doubled or tripled the normal price. Why not? It was worth an effort. Our attitude was simple. If you were stupid enough to give us three times the value of our land, we were smart enough to take your money.

In Panama (and everywhere), do not be ashamed to be ignorant. The property you love may fit your budget, but that does not mean you have to pay more than it is worth. Here is a suggestion, if you ever feel like "jumping on" a property you think is beautiful and affordable. Once you hear the price, just say, "Thank you. I will consider that. I do not know the price of (land/homes/condos, etc.) here, so I have more research to do. After that, if this seems like a good deal, I will get back to you." If the seller has quoted you a ridiculously high price, he or she is now aware that you are very likely going to discover that quickly and they will lose a sale. Who knows? The offering price may fall…quickly. Fine, but you still do not make an agreement. You go out and see other properties and talk to other people who live in the area. But in any case, you are far, far less likely to buy at a ridiculously high price. Forget "gringo price". Think "ignorance price". Protect yourself. Use common sense.

In Panama (and everywhere), do not be ashamed to be ignorant. The property you love may fit your budget, but that does not mean you have to pay more than it is worth. Here is a suggestion, if you ever feel like "jumping on" a property you think is beautiful and affordable. Once you hear the price, just say, "Thank you. I will consider that. I do not know the price of (land/homes/condos, etc.) here, so I have more research to do. After that, if this seems like a good deal, I will get back to you." If the seller has quoted you a ridiculously high price, he or she is now aware that you are very likely going to discover that quickly and they will lose a sale. Who knows? The offering price may fall…quickly. Fine, but you still do not make an agreement. You go out and see other properties and talk to other people who live in the area. But in any case, you are far, far less likely to buy at a ridiculously high price. Forget "gringo price". Think "ignorance price". Protect yourself. Use common sense.

- Be prepared to adapt to a new human and physical environment. I am always a little surprised how many foreigners arrive thinking that Panama is really no different than their nation. It is different. You will not change Panama, so you will have to adapt to Panama. Everyone goes through this, whether it is a matter of getting used to the heat and humidity for those from a drier part of the world or understanding how to find professional assistance, negotiate a deal, and see it through. And no, your embassy is not here to take your "side" when you face a problem in adapting. You are responsible for you own life, not the taxpayers of your original home nation.

The list could go on for a couple pages or more, but these are some very fundamental points that I like to repeat when I have the chance. They are what they are because of the experience of thousands of RW members over the years.

In Conclusion

"No matter what we all know today, it is not going to be true in 10 or 15 years. You pick any year in history and go back and then look to see what everybody thought was true in that year, 15 years later the world had changed enormously. Enormously. And yet in that particular year everybody was convinced that this is the way the world was."

Jim Rogers, American businessman, investor and author (1942 – present)

Mr. Rogers is a very famous investor who has been very successful for decades. His point is well-taken. I can tell you that 15 years ago in 1999, when I was sitting in my home in the US, that I not only had no knowledge as to what was going to happen in the next 15 years for the world, the US, Europe, China, Panama, or any other nation, I also had no knowledge as to where I would be and what I would be doing today. He is right. The world has changed enormously and, in my little way, my life has changed enormously, but I could never have described any of those changes in 1999.

My best advice to you is to be flexible and adaptable. The world is going to go on changing and so will we. We all worry about our futures and we try to plan for them, as best we can. But above all, you and I, all of us, must focus on where we are today and where we will be tomorrow. By considering Panama as a place to relocate, you are doing exactly that. As I often say, I do not care whether you come to Panama or not. I only care that you find the right home for you, wherever that might be. The important point is that you are looking for your own “strategic vision" and preparing your own “plan". I admire you for doing that and I wish each and every one of you the best possible success!

And so another commentary is finished. If you have read any of the others, you know exactly what will happen now. It is my own way of expressing the humility that I recommend to others. So let us read it together again.

No one knows the future. Free markets go up and free markets go down. The future is not a simple extrapolation of the present. Anything can happen. Everyone has an opinion and those words above are just opinions.