What's the Panama Pensionado Program and how does it work for property taxes?

Roy Cannon - Gestoria Cocle - main office in Penoneme

The Pensionado Visa in Panama is based on your status and has a minimum pension amount that is required.

There are no concessions for Pensionados when it comes to property taxes.

Other property related expenses do have potential Pensionado discounts (utilities and mortgages)

There are no concessions for Pensionados when it comes to property taxes.

Other property related expenses do have potential Pensionado discounts (utilities and mortgages)

The Pensionado Visa in Panama is based on your status and has a minimum pension amount that is required.

There are no concessions for Pensionados when it comes to property taxes.

Other property related expenses do have potential Pensionado discounts (utilities and mortgages)

There are no concessions for Pensionados when it comes to property taxes.

Other property related expenses do have potential Pensionado discounts (utilities and mortgages)

Posted February 4, 2013

David Bayliss - KW PACIFICA

There is a property tax exemption in Panama that has nothing to do the Pensionado program or any type of visa.

There is a property tax exemption in Panama that has nothing to do the Pensionado program or any type of visa. The property tax exemption was started by the government of Panama to attract the international market to buy real estate, locate here, spend money, and to employ more Panamanians, and it’s working. Initially, the property tax exemption was given to a building (including condos) or a house at a certain time of construction. Initially they...

There is a property tax exemption in Panama that has nothing to do the Pensionado program or any type of visa.

There is a property tax exemption in Panama that has nothing to do the Pensionado program or any type of visa. The property tax exemption was started by the government of Panama to attract the international market to buy real estate, locate here, spend money, and to employ more Panamanians, and it’s working. Initially, the property tax exemption was given to a building (including condos) or a house at a certain time of construction. Initially they started out with a 20-year exemption on certain properties. Since that time, they’re no longer doing 20-year exemptions; they’re doing 10-year exemptions.

With that being said, if your building qualified for the 20-year property tax exemption, the person who buys that apartment would be able to then register that exemption and not pay property tax for the number of years left on the exemption. So right now, there are no buildings with twenty years remaining on the exemption, but there are buildings that would have, for example, around 18 years or so, depending on when the building was completed.

The property tax exemption is on the building itself and not the land underneath. So, for instance, you buy a property and it’s going to be property tax free for 15 years. You will owe the undivided portion of the land tax underneath your condo building, which could be from $200 to $400 depending on how many units there are over how much land.

In this example, the $200 - $400 is a one-time annual fee or annual tax that you would pay. This is one of the prime motivating factors for people to move to Panama buy real estate. For example, in Dallas, I paid off my house, but my property tax was $11,997 a year. That’s a lot of money for paid up house. And it’s not inconceivable that you buy a condo in Panama and you don’t pay property tax for the next 8 or 10 years. That’s a long time not paying property tax. This tax is not deferred that you owe it later. There is just no property tax for duration of time.

The exemption is fully transferrable and it stays with that property. However, the owner still needs to re-apply for the exemption when the property changes hands. Probably half of the people that buy never actually file for the exemption and they only find out when they go to sell the property that they could have claimed it. So just because the building has the exemption on it, doesn’t mean you get it unless you file the paperwork with your attorney.

(Home with pool and terrace overlooking the ocean, Coronado, Panama, pictured.)

Posted March 16, 2016

Kathya de Chong - Alto Boquete Condominios

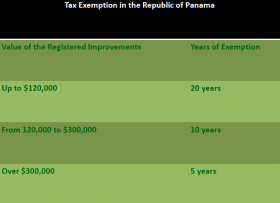

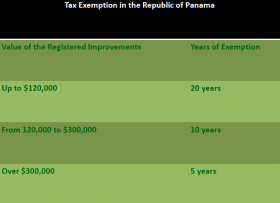

There is an exemption for property taxes on new construction n Panama for up to the first twenty years, regardless of whether or not the owner of the property has a Pensionado Visa or not. The amount of the exemption in property taxes depends on the price of the property. (Please see chart to the right.)

There is an exemption for property taxes on new construction n Panama for up to the first twenty years, regardless of whether or not the owner of the property has a Pensionado Visa or not. The amount of the exemption in property taxes depends on the price of the property. (Please see chart to the right.) For properties in Panama that are relatively inexpensive like low cost housing for lower income families, the tax exemption given is for 20...

There is an exemption for property taxes on new construction n Panama for up to the first twenty years, regardless of whether or not the owner of the property has a Pensionado Visa or not. The amount of the exemption in property taxes depends on the price of the property. (Please see chart to the right.)

There is an exemption for property taxes on new construction n Panama for up to the first twenty years, regardless of whether or not the owner of the property has a Pensionado Visa or not. The amount of the exemption in property taxes depends on the price of the property. (Please see chart to the right.) For properties in Panama that are relatively inexpensive like low cost housing for lower income families, the tax exemption given is for 20 years. This can also depend on the price of the property, but most of the time the exemption given here in Panama is 20 years.

For more expensive properties here in Panama, on the other hand, there is less tax exemption. This is because the law is made to benefit people who are buying properties in Panama to live in and not for investment. Tax exemption in Panama given for properties worth up to $120,000 is 20 years; from $120,000 - $300,000 is 10 years, and over $300,000 is five years.

Whether or not you receive the property tax exemption is not dependent on whether you are a foreigner or a Panamanian who’s buying the property in Panama because the exemption is applied to the property and not to the buyer. If you sell the property to someone else, or if you buy a property from someone else and there is still time left on that exemption, the exemption will continue with the new owner.

When you have a condo unit here in Panama, property taxes work exactly the same way. In our development, Alto Boquete Condominiums, the average price of units is $200,000. If you buy a unit in our development for $200,000, you get a ten-year exemption.

Posted July 12, 2017