Do I need to renounce or relinquish my US citizenship or get a dual citizenship to move or live abroad?

Pedro Fabrega Jr - Hotel Los Mandarinos

No you do not

No you do not

Posted March 8, 2013

Lucia Haines - Panama Realtor Inc.

You absolutely do not have to renounce your US citizenship if you move or live abroad... but you do have to go through an immigration process, so that you can obtain a Residency Visa. There are lots of different types of Residency Visas in Panama available to choose from, and many of them, most notably the Pensioners Visa (Pensonado) include benefits such as discounts on:

- restaurants (25% and 15% on fast food)

- Hospital ( 15% including private...

You absolutely do not have to renounce your US citizenship if you move or live abroad... but you do have to go through an immigration process, so that you can obtain a Residency Visa. There are lots of different types of Residency Visas in Panama available to choose from, and many of them, most notably the Pensioners Visa (Pensonado) include benefits such as discounts on:

- restaurants (25% and 15% on fast food)

- Hospital ( 15% including private clinic)

- medication (20% including prosthetics, wheelchairs and canes)

- utilities (25% on telephone, water, and electricity)

- recreation (50% this includes movies, sporting events, concerts and Museums)

Posted June 18, 2013

Alan Filliger - Alana la Casa del Arte

You do not need to renounce or relinquish your USA or Canadian citizenship if you decide to live abroad. You keep your citizenship, change your lifestyle, enjoy a lot of new and interesting stuff and become a more rounded and knowledgeable person.

I feel it is important to be willing to experience new things, a different culture, different ways of doing things and accept some risks of the unknown. It is all worth it though when you break the...

You do not need to renounce or relinquish your USA or Canadian citizenship if you decide to live abroad. You keep your citizenship, change your lifestyle, enjoy a lot of new and interesting stuff and become a more rounded and knowledgeable person.

I feel it is important to be willing to experience new things, a different culture, different ways of doing things and accept some risks of the unknown. It is all worth it though when you break the routine you are used to and enjoy something new.

Posted July 24, 2013

Karyn Saunders

No, you do not need to renounce or relinquish your US citizenship and No, you don't need tdo get a dual citizenship to move or live abroad. I am still a Canadian Citizen and Resident who now holds a Panamanian Residency Visa. As a US citizen you can do the same. Dual passports is another story for a US citizen but you do not need a passport in Panama to live here permanently. As a Canadian you can have multiple passports and many do.

No, you do not need to renounce or relinquish your US citizenship and No, you don't need tdo get a dual citizenship to move or live abroad. I am still a Canadian Citizen and Resident who now holds a Panamanian Residency Visa. As a US citizen you can do the same. Dual passports is another story for a US citizen but you do not need a passport in Panama to live here permanently. As a Canadian you can have multiple passports and many do.

Posted August 11, 2013

RICH Novak - RE/MAX Beaches & City! INC.

To answer the question directly, it is not necessary for you to relinquish your citizenship or even get a dual citizenship in order to live in Panama. You can be a perpetual tourist, if you follow the rules, or you can get one of the different visas available.

When you come to Panama, you can come as a tourist or a visitor, and stay for 180 days, but then you have to leave the country for 72 hours. Then you can come back again. There are people who are stay in...

To answer the question directly, it is not necessary for you to relinquish your citizenship or even get a dual citizenship in order to live in Panama. You can be a perpetual tourist, if you follow the rules, or you can get one of the different visas available.

When you come to Panama, you can come as a tourist or a visitor, and stay for 180 days, but then you have to leave the country for 72 hours. Then you can come back again. There are people who are stay in Panama indefinitely as perpetual tourists.

By law a Pensionado in Panama does not need a passport and possible Panamanian citizenship, but the government of Panama recently changed that rule, so that now, after a person’s has legally been here for five years, you can apply for citizenship. Nobody that I know has ever become a citizen and received a Panamanian passport that I know of, though, so it is absolutely not necessary in order to stay in Panama.

There are programs like the one they have in Saint Kitts, where you could start with an investment of US $350,000 and receive citizenship. To renounce your citizenship is a gray area. You may want to renounce your citizenship or you may not.

I know a Canadian guy who says that he has done everything to become a citizen of Panama, but the president of Panama needs to approve his application to become a citizen. That is the only thing he is says he needs, and I am waiting to see if that happens.

I am a US citizen and because I am a US citizen living overseas, I have to put up with some crazy laws. Because I am a citizen of the United States, I have to send in a report to Detroit telling the government what money I have in foreign bank accounts, and if I do not tell them, the penalty is 50% per year. So just because you already live in another country, does not relieve you of taxes and some other legal obligations in the US, because you are still a US citizen.

Posted October 30, 2014

Don Nelson - TaxMeLess

You do not have to renounce your US Citizenship to live any where in the world. Most countries will allow you to become a permanent resident without becoming a citizen of that country.

However, if you do renounce your US Citizenship, you will never have to pay US taxes or file a US tax return again. While you remain a US citizen you must file a tax return each year if your income exceeds a certain minimum amount, and often pay US taxes, in...

You do not have to renounce your US Citizenship to live any where in the world. Most countries will allow you to become a permanent resident without becoming a citizen of that country.

However, if you do renounce your US Citizenship, you will never have to pay US taxes or file a US tax return again. While you remain a US citizen you must file a tax return each year if your income exceeds a certain minimum amount, and often pay US taxes, in addition to those in the foreign country you have chosen to live. Surrendering your US citizenship may be good tax planning if you are moving to a low tax or no tax country.

If you need assistance with the legal or tax aspects of surrendering your US citizenship our firm can assist you. We have represented or advised over a hundred clients with this process who are now no longer having to file a US tax return.

Posted November 16, 2014

John Gilbert - PanamaKeys

You do not need to renounce or relinquish your US citizenship or get dual citizenship to move or live abroad. However, the laws in some countries are more cumbersome than others. I found a great situation in Panama where as a foreigner coming in, there’s no need for you to pick up a second citizenship. That option is available for you as time goes by, but you don’t need to do it.

You do not need to renounce or relinquish your US citizenship or get dual citizenship to move or live abroad. However, the laws in some countries are more cumbersome than others. I found a great situation in Panama where as a foreigner coming in, there’s no need for you to pick up a second citizenship. That option is available for you as time goes by, but you don’t need to do it. What was right for me and my family was the Friendly...

You do not need to renounce or relinquish your US citizenship or get dual citizenship to move or live abroad. However, the laws in some countries are more cumbersome than others. I found a great situation in Panama where as a foreigner coming in, there’s no need for you to pick up a second citizenship. That option is available for you as time goes by, but you don’t need to do it.

You do not need to renounce or relinquish your US citizenship or get dual citizenship to move or live abroad. However, the laws in some countries are more cumbersome than others. I found a great situation in Panama where as a foreigner coming in, there’s no need for you to pick up a second citizenship. That option is available for you as time goes by, but you don’t need to do it. What was right for me and my family was the Friendly Nation’s Visa. We came in to Panama wanting to start a business, which we did, and the corporation came with my Friendly Nation’s Visa. It was a qualification criteria for my Friendly Nation’s Visa, which gives me a Permanent Residency Visa, which means that I have a legal right to be here. Many people don’t choose to even go that far. People come and go on their Tourist Visa in Panama which gives you the right to stay in Panama and drive in the country on your foreign license for 90 days.

On the other hand, the US isn’t going to say, “Hey, you’re living in Panama. You’re no longer a US citizen.” The fact that you live outside of the United States has no bearing or consequence whatsoever on the fact that you are a United States citizen. You have 100% of the rights to vote, and 100% of the rights to all that your citizenship entails as being a citizen of the United States of America.

You can still receive your Social Security checks or benefits living in Panama and in other places in the world as an expat. That is one of the primary ways that many of the retirees are able to live here in Panama- through their Social Security benefits. From time to time, there are things that you need to do as a recipient of Social Security that don’t change. An example would be proving that you’re still alive, and those types of things. The qualifiers are that you worked a certain number of years in the United States and earned a certain level of retirement benefits. It has no bearing whatsoever on where your ZIP Code’s going to be in the future.

The US embassy in Panama has great services throughout the country that can walk you through those things that are relevant. As far as renewing your passport, and doing many things that you would do with any consulate is freely done here in Panama.

(John Gilbert with his children in Panama, pictured.)

Posted March 31, 2017

John Ohe - Hola Expat Tax Services

You absolutely do not need to renounce or relinquish your US citizenship or get dual citizenship when you move and live abroad.

You absolutely do not need to renounce or relinquish your US citizenship or get dual citizenship when you move and live abroad. I've been living abroad for about a little over five years. Now, I live in Guatemala and have been here for over four years. I am only a US citizen. I'm not even a permanent resident of Guatemala. I've got three children and the last of one was born in Guatemala. Getting residency for my youngest child was very easy based on the...

You absolutely do not need to renounce or relinquish your US citizenship or get dual citizenship when you move and live abroad.

You absolutely do not need to renounce or relinquish your US citizenship or get dual citizenship when you move and live abroad. I've been living abroad for about a little over five years. Now, I live in Guatemala and have been here for over four years. I am only a US citizen. I'm not even a permanent resident of Guatemala. I've got three children and the last of one was born in Guatemala. Getting residency for my youngest child was very easy based on the local rules. However, it's not a step that I really needed to take because we frequently travel, whether we're going back to the US or going to other countries on a vacation.

Guatemala happens to have a very generous tourist visa situation where they give 90 days for Americans. If you want, you can get an extension on 90 days up to 180 days in Guatemala without having to leave, which a bunch of countries have. Panama has an automatic 180-day visa for US citizens. Nicaragua and Costa Rica allow 90 days for US citizens. It's easy to leave the country, stay out of the country for a few days, and come back in.

Residency status is certainly not needed. Relinquishing your US citizenship is absolutely not needed. I have some clients who are considering residency and relinquishing their US citizenship for tax reasons, but it could be quite problematic to relinquish your citizenship. There is a lot of paperwork involved. If you have a lot of assets, there is an exit tax associated with giving up your US citizenship that can be quite painful.

Giving up your US citizenship is really not needed for most people and 99.9% of US citizens don't need to do it to live abroad. Depending on the tourist visa situation, you may even need to establish permanent residency status in the local country you're moving to.

(People of Mayan descent in a horse race in Todos Santos Cuchumatán, Guatemala, pictured.)

Posted August 9, 2017

Ross - Abroad We Go

There is absolutely no need to renounce or relinquish your US citizenship if you want to move or live abroad. I don’t have dual citizenship. You don’t have to have dual citizenship when living abroad, but there may be an advantage having one, especially if you’re dealing with a country with lower or no taxation.

There is absolutely no need to renounce or relinquish your US citizenship if you want to move or live abroad. I don’t have dual citizenship. You don’t have to have dual citizenship when living abroad, but there may be an advantage having one, especially if you’re dealing with a country with lower or no taxation. I would highly recommend that anyone planning to move abroad speak with their tax advisor or financial planner and get the best advice for the...

There is absolutely no need to renounce or relinquish your US citizenship if you want to move or live abroad. I don’t have dual citizenship. You don’t have to have dual citizenship when living abroad, but there may be an advantage having one, especially if you’re dealing with a country with lower or no taxation.

There is absolutely no need to renounce or relinquish your US citizenship if you want to move or live abroad. I don’t have dual citizenship. You don’t have to have dual citizenship when living abroad, but there may be an advantage having one, especially if you’re dealing with a country with lower or no taxation. I would highly recommend that anyone planning to move abroad speak with their tax advisor or financial planner and get the best advice for the changes. This varies in different countries so potential expats need to have the most accurate information to make those decisions.

(Countryside scenery in Ometepe, Nicaragua, pictured.)

Posted October 30, 2017

Robert Irvin - The Oaks Tamarindo Condominiums-- Costa Rica

There is no need for you to renounce or relinquish you US citizenship if you move abroad. The same is true for Canadians and citizens from anywhere else in the world. You can live in Costa Rica either as a perpetual tourist or a permanent resident.

There is no need for you to renounce or relinquish you US citizenship if you move abroad. The same is true for Canadians and citizens from anywhere else in the world. You can live in Costa Rica either as a perpetual tourist or a permanent resident. Being a perpetual tourist means that you need to leave the country every ninety days, which should not be an inconvenience for someone who is a traveler anyways.

For someone who...

There is no need for you to renounce or relinquish you US citizenship if you move abroad. The same is true for Canadians and citizens from anywhere else in the world. You can live in Costa Rica either as a perpetual tourist or a permanent resident.

There is no need for you to renounce or relinquish you US citizenship if you move abroad. The same is true for Canadians and citizens from anywhere else in the world. You can live in Costa Rica either as a perpetual tourist or a permanent resident. Being a perpetual tourist means that you need to leave the country every ninety days, which should not be an inconvenience for someone who is a traveler anyways.

For someone who lives where I do, however, in Tamarindo, Costa Rica, which is about 2.5 hours from the Nicaraguan border, being a perpetual tourist means a simple drive up to the border once every three months, where he can simply walk across the border, get your papers stamped, walk back across the border, get your paper stamped, and be home again on the same day.

The process a perpetual tourist has to endure every 90 days takes about 6 hours – 2 ½ hours up, 2 ½ hours back and hour across the border. You can stay in Costa Rica as a perpetual tourist because by doing so, you are fundamentally invisible to the Costa Rican government, except for the fact that you get your passport stamped. A lot of people do that.

Permanent residency in Costa Rica is extremely simple. You can apply for permanent residency in Costa Rica on the basis of being a recipient of a pension of around US $1,500 a month. You can also apply for permanent residency on the basis of being an investor with an investment amount of $200,000.

If you marry a Costa Rican, then you can get a residency on the basis of family. The bureaucracy in Costa Rica is slow moving and inefficient, but one of the big advantages you’ll get from that is you don’t have to actually get the residency to enjoy the benefits of it; you simply have to apply for it. Once you’ve applied for your residency, you get a piece of paper saying that you’ve applied for it. While your residency application is pending, which may take about a year, the government of Costa Rica treats you as if you are already a resident, so you don’t have to leave the country.

There is also an option to apply for a citizenship after a few years, or sooner if you marry a Costa Rican. You do not have to renounce your US citizenship; I’ve never heard of that as being an issue.

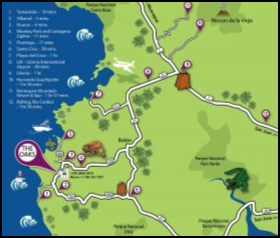

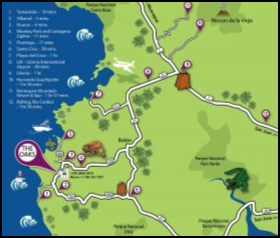

(Map showing the location of The Oaks Tamarindo Condominiums, Costa Rica, pictured.)

Posted November 3, 2017

Zach Smith - Anywhere

Under most circumstances, having a dual citizenship is the preferred way to go about when moving abroad because formally renouncing your citizenship is actually a rather complicated process. Dealing with the IRS is never fun and pre-paying future taxes in order to relinquish citizenship is a significant burden vs continuing to file taxes as a US citizen despite living abroad.

There are some tax advantages living abroad. Most notably, if you’re out of the country for more...

There are some tax advantages living abroad. Most notably, if you’re out of the country for more...

Under most circumstances, having a dual citizenship is the preferred way to go about when moving abroad because formally renouncing your citizenship is actually a rather complicated process. Dealing with the IRS is never fun and pre-paying future taxes in order to relinquish citizenship is a significant burden vs continuing to file taxes as a US citizen despite living abroad.

There are some tax advantages living abroad. Most notably, if you’re out of the country for more than 330 days, you will get a tax exemption called the Foreign Earned Income Exclusion. In a nutshell, if you have low income then you are not going to be paying the US taxes. The Foreign Income Exclusion stops a little over $100,000 in earned income for a single US taxpayer. What’s nice about it is that you pay 0% on earnings up to the amount of the exclusion and then that first money earned above that is taxed at a lower rate. This is what I understand but it’s probably something that is best to revisit from a financial perspective especially when you are getting closer to making that decision. You do not need to renounce or relinquish your US citizenship in order to live in another country. Making this decision is not something to be taken lightly as revoking your citizenship is a big deal. Certainly review all matters tax related since rules definitely change and how your income arrives, w-2 vs. investment, vs foreign payroll are all factors that should be considered and advised by a tax professional.

There are some tax advantages living abroad. Most notably, if you’re out of the country for more than 330 days, you will get a tax exemption called the Foreign Earned Income Exclusion. In a nutshell, if you have low income then you are not going to be paying the US taxes. The Foreign Income Exclusion stops a little over $100,000 in earned income for a single US taxpayer. What’s nice about it is that you pay 0% on earnings up to the amount of the exclusion and then that first money earned above that is taxed at a lower rate. This is what I understand but it’s probably something that is best to revisit from a financial perspective especially when you are getting closer to making that decision. You do not need to renounce or relinquish your US citizenship in order to live in another country. Making this decision is not something to be taken lightly as revoking your citizenship is a big deal. Certainly review all matters tax related since rules definitely change and how your income arrives, w-2 vs. investment, vs foreign payroll are all factors that should be considered and advised by a tax professional.

Posted January 30, 2018